In today's dynamic market landscape, volatility poses a constant challenge for traders. To navigate in this environment, modern investors are utilizing the power of technology. Advanced algorithmic trading platforms provide instantaneous market data and powerful analytical tools, enabling traders to make strategic decisions with precision. Furthermore, high-frequency trading systems can execute trades at lightning speed, capitalizing on fleeting opportunities and minimizing potential losses. This technological revolution has democratized access to financial markets, empowering both seasoned professionals and individual investors to participate in the global economy.

Exploring PIMCO's Latest Strategies: PIMMTF, MTF Tools, and Trader Alliance Profit Plan

PIMCO continues to push the boundaries of financial management with its innovative offerings. One notable example is the launch of PIMMTF, a unique fund designed to optimize returns through a focused strategy. Complementing PIMMTF are the MTF Tools, a suite of sophisticated resources that empower clients with real-time market insights. Adding to this dynamic ecosystem is the Trader Alliance Profit Plan, a collaborative initiative aimed at fostering growth among traders.

- The fund's core objective is to achieve superior performance through a carefully curated portfolio of assets.

- Offer traders with the ability to analyze market trends, execute trades seamlessly, and manage their portfolios effectively.

- The Trader Alliance Profit Plan fosters a culture of community among traders, facilitating the dissemination of valuable insights and strategies.

Unlocking Portfolio Growth: How Technology is Reshaping Investment Strategies

Technology has disrupted the investment check here landscape, presenting new opportunities for portfolio growth. Algorithmic trading platforms leverage data analysis and machine learning to manage trades with precision, allowing investors to enhance returns.

Moreover, online brokerage services have opened up investing to a broader population. Robo-advisors provide tailored investment advice based on individual tolerance, making it easier for beginners to navigate the complex world of finance.

Through digital assets, technology is introducing new investment vehicles. This changing technological landscape presents both challenges and advantages for investors who are willing to adapt these innovations.

Evolving Analytical Strategies: Embracing Cutting-Edge Tools for Smarter Trading

The world of trading is rapidly evolving at an unprecedented pace. Traders are no longer solely relying on time-tested methods and market trends. They're adopting cutting-edge tools and technologies to gain a distinct advantage. This includes sophisticated algorithms that can process massive amounts of information in real time, identifying hidden patterns and opportunities that human intuition might miss.

- Deep learning algorithms are revolutionizing trading by automating tasks.

- Text mining tools scan social media to gauge market opinion.

- Algorithmic trading platforms execute trades at lightning speed, reacting instantly to market movements.

By integrating these cutting-edge tools, traders can make more intelligent trades, ultimately improving their trading outcomes.

Maximizing Returns: PIMCO Solutions for Asset Optimization in a Volatile Market

In today's dynamic and fluctuating market environment, investors are constantly seeking strategies to mitigate risk while striving to achieve their financial goals. PIMCO, a leading global investment management firm, offers a suite of innovative solutions designed to maximize asset returns even in periods of heightened volatility. By leveraging our deep expertise and advanced investment strategies, we aim to help investors navigate complexities and position their portfolios for long-term success. Our solutions encompass a wide range of asset classes, including equities, and are tailored to meet the individual needs of our clients.

- The firm's approach to asset optimization is characterized by a rigorous methodology, which involves closely analyzing market trends and macroeconomic factors. This allows us to identify emerging opportunities and adjust our portfolios accordingly.

- Moreover, PIMCO's team of experienced portfolio managers possesses a deep understanding of financial instruments. They are committed to achieving consistent returns while adhering to strict risk management principles.

- Ultimately, PIMCO is dedicated to providing investors with the tools and expertise they need to thrive in the current market environment. Our solutions are designed to help clients grow wealth.

The Future of Investing: Harnessing Technology to Protect and Grow Your Wealth

The landscape of investing is shifting at a rapid pace, with technology playing an increasingly pivotal role. Investors are now empowered by sophisticated platforms and tools that provide unprecedented access to opportunities. Artificial intelligence (AI) and machine learning are disrupting traditional investment strategies, enabling data-driven decision-making.

Robo-advisors have emerged as accessible solutions for investors, offering customized portfolios based on risk tolerance and investment objectives. Blockchain technology is also emerging in the investment world, promising increased efficiency through decentralized ledgers.

As we proceed into the future, it is essential for investors to integrate these technological advancements to protect their wealth and enhance returns. By leveraging the power of technology, investors can navigate the complexities of the market with greater confidence and achieve long-term financial success.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Tahj Mowry Then & Now!

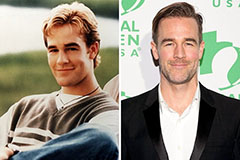

Tahj Mowry Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!